That's a vast range, which is why it's so essential to compare prices. Decide On Your Car Insurance Deductible When it comes to insurance, an insurance deductible is the quantity of money you agree to pay toward covered repairs. car.

If you are seeking to conserve cash, it makes feeling to have high deductibles, as long as you have the money to cover the expenditure ought to an accident occur. The greater your insurance deductible is, the lower your costs will be. As you determine the deductibles that help you, take into consideration these elements: Revenue House spending plan Personal savings Readily available credit report Make certain you just concur to what you can in fact pay for.

8. Select Your Auto Insurance Coverage Service Provider Since you have several quotes to compare, consider what various other factors will certainly affect your vehicle insurance coverage experience (dui). Just because a business claims to have low-cost automobile insurance policy prices does not imply it provides the most effective coverage. Here are some points to seek as you review prospective business.

Don't neglect to inspect the company's rating on BBB, if it has one. Speak to the individuals closest to you concerning the business they use. Find out if cases have been paid as well as determine their contentment degrees. Possibly you will certainly discover Helpful hints your following company by finding out about just how delighted your relied on sources are.

insurance companies car insurance company cheap insurance

insurance companies car insurance company cheap insurance

Some service providers will certainly pack rewards such as roadside support or rental vehicle protection with your policy. It's feasible that the firm is billing less because it isn't paying out on insurance claims like it should (cheapest).

Not known Details About Auto Insurance Quotes - Usaa

You might be eligible for car insurance policy discounts if you: Bundle insurance with various other items and also solutions the business provides Receive protection for several cars Have a clean driving record Pay for the premium by the year or biannually instead than month-to-month Receive online declarations Drive a car with anti-theft or safety features Belong to a certain company that's associated with a business Serve in the U.S

Purchase Your Auto Insurance Coverage Plan Once you've selected the company you desire to function with and you like the quote you received, it's time to look over the terms prior to concurring to anything. While several individuals will certainly purchase automobile insurance policy without assessing all of this, it's not smart.

You will see your name, policy period, as well as premium quantity on this web page. There will likewise be a summary of the insurance policy protection along with the maximum dollar amount the insurance firm is responsible for.

It also mentions that gets protection. The carrier ensures that everything is clearly defined, so there is no misconception. You want to particularly check out anything that's omitted from your protection. You don't wish to discover this out when you submit a case. This part highlights your responsibility when you make an insurance claim.

Some Known Details About How Long Does It Take To Get Car Insurance? - Cover

Companies obtain a score in each of the following groups, as well as a general heavy score out of 5. Insurers with solid monetary rankings as well as customer-first company practices receive the highest possible scores in this category.

As soon as you've selected a policy, just choose a settlement choice to complete the deal - cheaper car. After that, you can download your evidence of insurance policy card and also print it out.

Insurance isn't one of the most exciting facet of vehicle possession, yet it is just one of the most important. Not only is your plan made to secure you from financial calamity in the event of a collision or associated injury, it is called for by most states if you possess an automobile. Customer Information suggests looking around for the very best policy, not just when you acquire a car, yet periodically, to make certain you're constantly getting the best deal possible (auto).

There are a number of variables to think about as you shop for an automobile policy. For starters, it helps to recognize what associates insurance providers think about when they create your month-to-month premiums, consisting of the complying with factors: Chauffeur profile: Age, driving experience, and also motorist history all affect the price of your costs.

Is it far better to buy your car insurance coverage online or overcome a representative? That depends on your needs and also what you're comfortable doing. In this article, we at the Home Media evaluates team describe where you can buy online car insurance and when you may be much better off calling an agent. car insurance.

What Does Shopping For Auto Insurance - Mass.gov Do?

Where to purchase automobile insurance coverage online Nearly every significant insurance company offers a way to obtain quotes for vehicle insurance online, though some need you to speak to an agent prior to you can settle your acquisition. low cost. Lots of firms, nonetheless, permit you to finish the entire procedure on the web, from quote to purchase.

Nonetheless, the majority of the purchase process can still be finished on the insurer's internet site. laws. On-line vehicle insurance policy purchase procedure The on the internet insurance coverage purchase process is similar for the majority of companies. If the insurance company supplies cars and truck insurance policy online, you can get any standard sort of insurance coverage you 'd need right from your computer or phone.

The common kinds of cars and truck insurance include: Here are some steps to follow to get cars and truck insurance online: 1. Get an on the internet automobile insurance policy quote The very first step is to obtain a quote either through an insurer's internet site or by utilizing a totally free automobile insurance policy quote tool like the one listed below (cheap car).

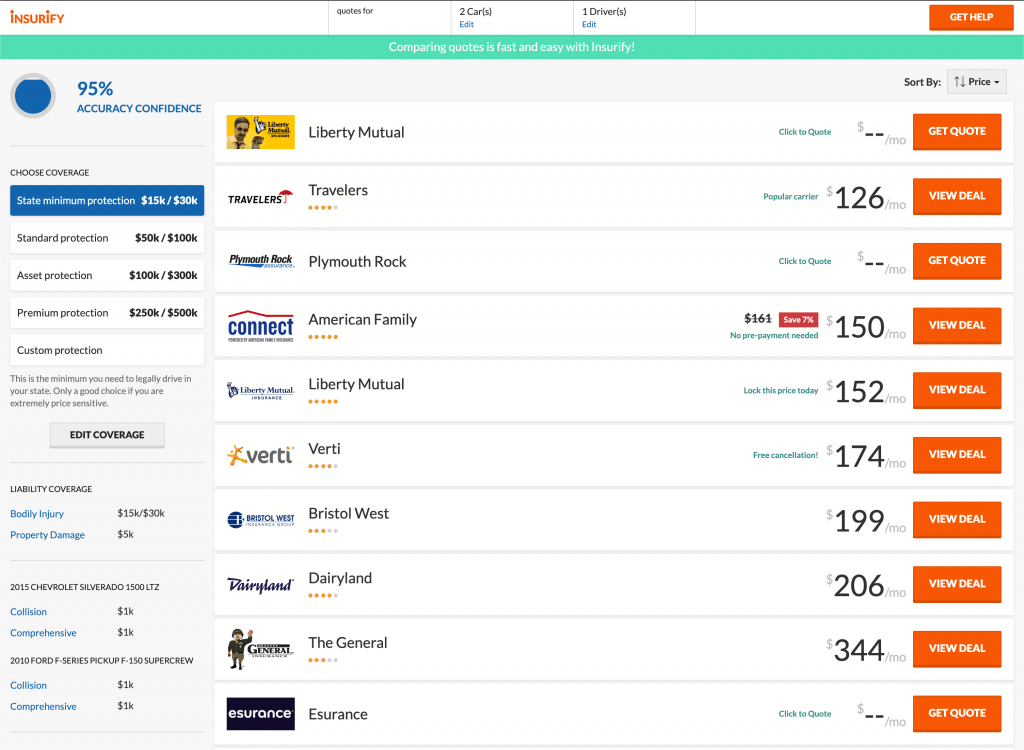

Contrast quotes After you supply the necessary information, some websites might provide instant auto insurance policy quotes that allow you to see the expense for the degree of protection you pick. Various other business might request your phone number or email address and have a representative get in touch with you with your quotes and also options.

Select protection Insurance providers that enable you to purchase a plan online will certainly assist you via the acquisition process, which ought to be simple. You'll be asked to choose the coverage you desire as well as add-on options like roadside help or accident mercy.

5 Simple Techniques For Insurance Navy Names The Most Affordable ... - Pr Newswire

cheapest auto business insurance cheapest auto insurance

cheapest auto business insurance cheapest auto insurance

cheaper insurance dui cheap

cheaper insurance dui cheap

Print your card Finally, print your insurance policy card from home. Expense of online cars and truck insurance policy According to our price price quotes, complete insurance coverage car insurance coverage costs a standard of about $144 per month ($1,732 per year) for good chauffeurs.

business insurance insurance companies business insurance car insured

business insurance insurance companies business insurance car insured

In our January 2022 automobile insurance study, we located 41% of participants had experienced a rate rise without an obvious cause. What impacts the expense of cars and truck insurance? The cost of any type of auto insurance plan will rely on a number of elements, including your: Area Driving background Credit rating rating (other than in California, Hawaii, Massachusetts as well as Michigan) Lorry Age Marital status Insurance coverage choice Deductible Is it less expensive to buy insurance policy online or through an agent? It is typically cheaper to buy cars and truck insurance policy online, as there are no agent fees or markups.

Car insurance costs by state Even if you buy auto insurance online, prices can differ significantly by location. Should you buy cars and truck insurance coverage online? You should choose your insurance provider based on which firm supplies the best auto insurance policy prices and insurance coverage for your requirements.

Use the device below to compare on-line car insurance estimates from top business in your location, or continue reading to discover even more concerning 2 of our suggested service providers, Geico and also USAA. Geico: Editor's Choice In our industry-wide review, we rated Geico amongst the leading car insurance coverage service providers in the country - auto.

Discounts like those for being an excellent driver (up to 26% off), being a good pupil (up to 15% off) and having several cars on your plan (up to 25% off) are just a few of the means to conserve with Geico - cheaper car.

7 Simple Techniques For How Do I Drive A New Car Home From The Dealership With ...

USAA: Reduced Rates for Armed forces USAA scored the greatest in every area in the J.D. Power Automobile Insurance Coverage Research. To be eligible for a vehicle insurance coverage policy with USAA, you must be a participant or professional of the United States armed forces or have a family participant or spouse that is a USAA member.

Completion result was a general score for each company, with the insurers that scored one of the most points topping the checklist. Here are the elements our ratings think about: Expense (30% of total score): Auto insurance coverage price estimates generated by Quadrant Info Solutions and also discount rate opportunities were both considered (vans).

Be prepared to give the driver's certificate number of everybody you wish to include on the policy so the insurance firm can draw your driving documents. credit. They'll also inquire about the year, make, model, and VIN of the vehicles you wish to insure in addition to the amount of miles you anticipate to drive every year.

It's illegal to drive without it in every state other than New Hampshire as well as Virginia. Not required by regulation in any type of state, loan providers normally require you to preserve accident insurance coverage if you have an automobile car loan or lease. It covers damage to your lorry that results from an accident with an additional lorry or stationary object, despite who is at mistake.

PIP is offered in states with "no-fault" insurance policy systems, and Medpay is readily available in states without "no-fault" systems. Some states require this kind of protection, and it's optional in others. There are a couple of various ways to buy vehicle insurance policy.

There are 3 primary resources you can resort to when you intend to purchase a policy. Buying a plan online or over the phone directly from the insurance coverage company is quick as well as practical. If you want to contrast insurance coverage alternatives and rates, you'll need to get in touch with each insurance company independently.

Are you wondering whether you should get an auto or insurance policy? Most insurance firms will automatically cover you if you're adding a new (or utilized) vehicle to an existing policy.

When you purchase insurance coverage with an insurance deductible attached, you get to select your insurance deductible amount. You can select different deductibles for different insurance coverage kinds (cars).