The driver would just pay their insurance deductible. When you do not need to pay a vehicle insurance coverage deductible, There are specific scenarios when individuals do not need to pay an automobile insurance policy deductible. If another motorist creates an accident and also their insurance coverage pays In many states, a vehicle driver that is responsible for causing a collision is obligated to spend for all damages connected with the collision.

If a person's own lorry is additionally harmed in the exact same case and also they desire to make a case for repair work under their accident insurance coverage, their insurance deductible will apply. If the particular kind of damage doesn't call for paying a deductible Sometimes, particular losses are covered without an insurance deductible.

If someone chose for no deductible when getting insurance coverage Insurers may enable individuals to opt for insurance coverage with a $0 deductible. If a person has no insurance Get more information deductible, they will not owe anything expense when a covered case takes place - cheap auto insurance. Remember, however, the cost of vehicle insurance policy will certainly be greater if someone picked a no-deductible policy.

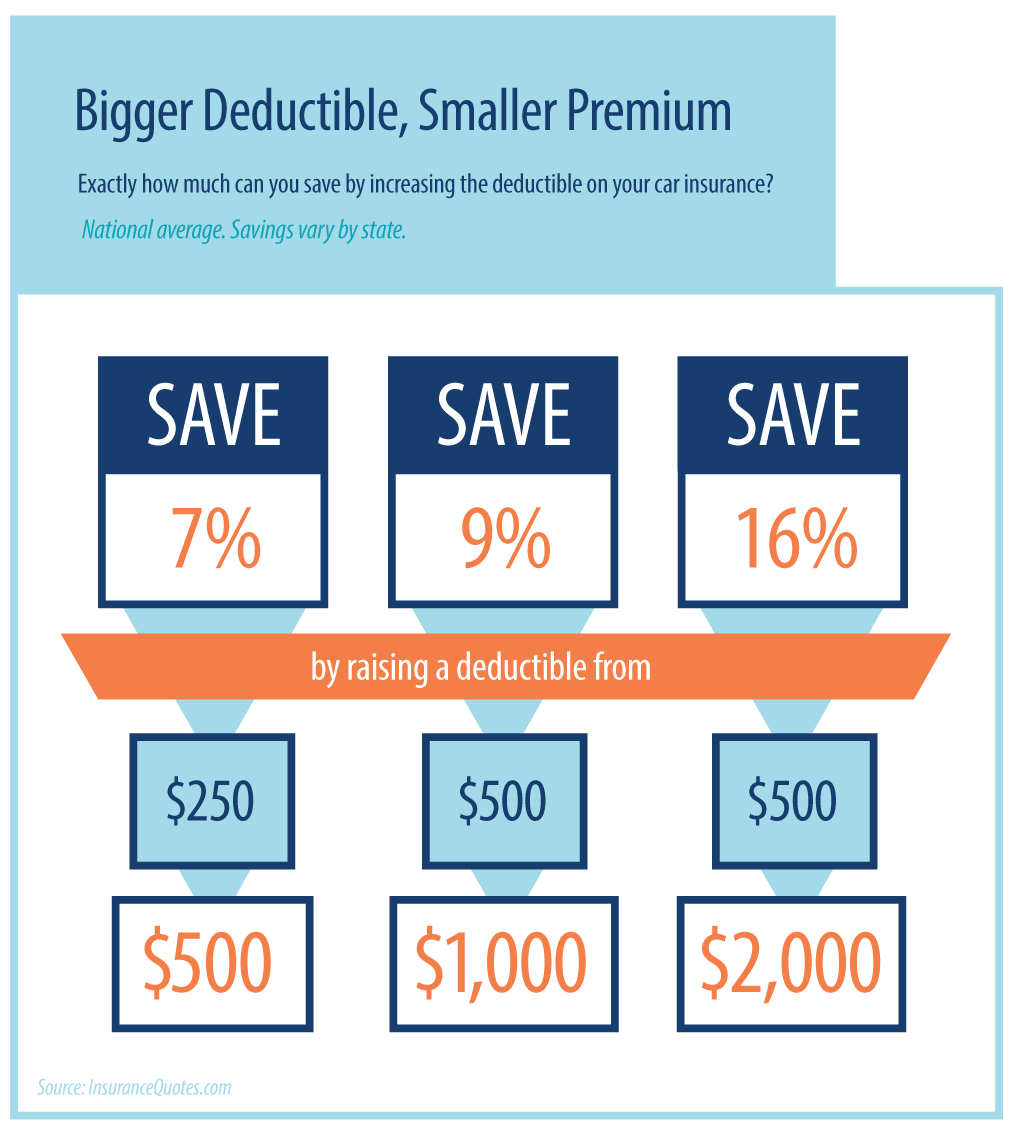

Generally, motorists require to choose a deductible for detailed coverage, accident protection, and also accident security. What's the average automobile insurance coverage deductible? The ordinary vehicle insurance deductible is $500. Individuals can select a deductible quantity anywhere from $0 to $2,000 with a lot of insurers. How a lot of an insurance deductible should I pick for my auto insurance policy? The goal when getting an vehicle insurance coverage quote is to get high quality and also inexpensive insurance - cheapest car insurance.

How Much Car Insurance Do I Need? - Ramseysolutions.com for Beginners

laws trucks affordable cheapest auto insurance

laws trucks affordable cheapest auto insurance

Below are some crucial considerations. Risk tolerance, When picking a plan with a higher deductible, people take a larger risk. They're betting that they will not require to make a case as well as pay out-of-pocket expenditures. Those that aren't comfy taking that opportunity may wish to pay greater premiums to pass even more of the threat of economic loss on their insurance provider.

Those who have a tendency to have actually little cash saved for unanticipated expenditures may desire to pick a reduced deductible. Individuals with a large reserve can probably afford to take a possibility of incurring greater out-of-pocket costs if they make an insurance policy claim. car insurance. The chance of a case, The extra likely it is a person will certainly make an insurance claim, the reduced they ought to set their insurance deductible.

But if the possibilities of a covered event are unlikely, a motorist might be better off maintaining their premiums low. Some individuals can conserve around $220 each year on detailed and crash coverage by switching from a policy with a $50 insurance deductible to one with a $250 deductible. By putting the premium cost savings right into a checking account, an individual might have adequate cash in around a year to cover the added deductible amount.

As long as a chauffeur does not enter a crash in much less than a year, they would certainly be far better off. The value of the car, If a car isn't worth a lot, it may not pay to have insurance coverage with a high deductible. State a motorist selects accident protection with a $1,000 deductible as well as their car is just worth $1,000.

Little Known Questions About Collision Car Insurance: What Is It? - Liberty Mutual.

In this situation, the vehicle driver would be far better off passing up crash coverage completely. Exactly how to prevent paying a car insurance deductible, The very best method to stay clear of paying an auto insurance coverage deductible is to avoid crashes, theft, or damage. Practice protective driving, comply with the customary practices, follow the speed limitation, and prevent driving in bad weather condition.

People can also select a plan with no deductible, albeit at a greater price. liability. Or they can register for a disappearing or vanishing insurance deductible with insurance firms that provide it. This will lower the amount of the deductible by a collection amount throughout each time period the chauffeur is without crashes (cars).

Discover what a vehicle insurance deductible is as well as exactly how it affects your automobile insurance policy coverage. The secret is knowing what deductibles and also coverages are and also how they impact auto insurance coverage.

What is a deductible? Put just, an insurance deductible is the amount that you concur to pay up front when you make an insurance claim, while the insurer pays the rest as much as your insurance coverage limitation. When picking your cars and truck insurance policy deductible, think of just how much you're willing to pay out of pocket if you require to make a case.

More About When Not To File An Insurance Claim - Usa Today

Uninsured driver This insurance coverage spends for damages if you or another covered person is wounded in an automobile accident brought on by a motorist that does not have obligation insurance - insurance companies. In some states, it might also spend for home damage. The coverage differs by state and also relies on plan stipulations. Without insurance motorist insurance coverage undergoes a policy limitation chosen by the guaranteed.

It differs by state as well as depends upon plan arrangements. Underinsured driver protection undergoes a policy restricts selected by the guaranteed. Rental reimbursement This protection spends for leasing costs if your vehicle is handicapped as a result of a protected loss - insured car. Daily allowances or limitations vary by state or policy stipulations.

You have to pay your automobile insurance deductible for the insurance claim to be total. Do not send out in your insurance claim to your insurance policy business if you can not pay your insurance deductible.

cheapest car risks cheaper auto insurance liability

cheapest car risks cheaper auto insurance liability

There are 2 other kinds of insurance that utilize deductibles:- PIP covers medical bills for you as well as your guests.- This type of insurance coverage shields you when you're struck by a chauffeur who doesn't have insurance.

The Deductible Rewards - Allstate Car Insurance Ideas

Nonetheless, there are some car insurer that do not need ahead of time repayment. Usually, it functions either means: Your insurance provider subtracts the insurance deductible from your claim payout. Allow's say your case is authorized for $2,500 and your deductible is $500. Your insurance provider writes you a look for $2,000.

You then pay them regular monthly till your insurance deductible is paid off. It assists if you have a lasting business partnership with your technician as well as can reveal a sincere requirement (cheap auto insurance).

There's no embarassment in requesting assistance when in demand. Establish a reasonable layaway plan and also stay real to it. If you remain in a circumstance where you can't pay your deductible there some points you can do. You require to discover a means to pay your deductible.

- A couple of states use the option of picking a $0 deductible on extensive insurance policy. - For any glass damage that can be repaired instead of replaced, you may not need to pay a deductible.

Zero Excess/deductible Car Rental Insurance - Auto Europe ® Fundamentals Explained

Noted listed below are various other things you can do to reduce your insurance prices. 1. Search Rates vary from firm to firm, so it pays to shop around. Access the very least three cost quotes. You can call companies straight or gain access to details online. Your state insurance coverage division may also give comparisons of prices charged by significant insurance companies - cars.

It's crucial to pick a firm that is financially stable. Obtain quotes from various types of insurance coverage companies. These firms have the very same name as the insurance coverage company.

Others do not use representatives. They market directly to customers over the phone or using the Internet. Don't shop by cost alone. Ask friends and family members for their suggestions. Contact your state insurance department to figure out whether they offer info on consumer complaints by company - car. Select an agent or business rep that puts in the time to answer your concerns.

2. Before you get a car, compare insurance coverage expenses Prior to you buy a brand-new or previously owned vehicle, check out insurance policy prices. Auto insurance premiums are based partly on the vehicle's price, the expense to fix it, its general safety document and the possibility of burglary. Many insurance providers provide discounts for attributes that decrease the danger of injuries or burglary. cheapest auto insurance.

The Best Guide To Collision And Comprehensive Insurance Explained - Time

Evaluation your insurance coverage at renewal time to make sure your insurance coverage requirements haven't transformed. Purchase your home owners as well as vehicle protection from the exact same insurance company Several insurance firms will certainly provide you a break if you get two or even more kinds of insurance.

Inquire about team insurance policy Some firms supply decreases to vehicle drivers that get insurance through a team plan from their companies, with specialist, business and alumni groups or from other associations (affordable). Ask your employer and inquire with groups or clubs you are a member of to see if this is feasible.

Look for other discount rates Business use discounts to insurance holders that have not had any kind of accidents or relocating violations for a variety of years. You might also get a price cut if you take a defensive driving program. If there is a young vehicle driver on the policy who is a great pupil, has actually taken a motorists education and learning program or is away at college without a vehicle, you may also receive a lower rate.

The vital to savings is not the discounts, but the final price. A company that offers couple of price cuts may still have a reduced overall price. Federal Resident Info Center National Consumers Organization Cooperative State Research, Education, and also Expansion Solution, USDA.

The Single Strategy To Use For Auto Body Repair Customer: Legal To Waive Insurance ...

You have broad collision insurance coverage, If you have broad collision insurance coverage you might be able to have your insurance deductible waived: If you are less than half liable for the collision, If you are greater than one-half liable, the insurance deductible stands as well as you need to pay it - dui. If the various other person in the crash is entirely liable, that person's insurance coverage will commonly pay all fixing charges, including what you would have paid for the deductible2.

CDWs do not pay if the individual who strike you involves you in a hit-and-run mishap. 3. The other driver is without insurance, In some states you can purchase an uninsured motorist protection-damage policy (UMPD), which covers you as much as a defined quantity if the other chauffeur associated with the crash doesn't have car insurance policy - low-cost auto insurance.

You sue with your insurance business to cover the damages to your vehicle. When you submit a cars and truck insurance claim, you need to pay a deductible prior to your insurance provider covers the staying prices. Let's claim your lorry has $5,000 worth of damages as well as you have a $1,000 insurance deductible.

As soon as you have actually paid the deductible, the vehicle insurance coverage firm will take over., after that the other chauffeur's insurance company will certainly pay for your fixings and also you will not have to pay your deductible.